sbi card is the credit card division of the State Bank of India (SBI) and operates as SBI Cards and Payment Services Limited, a joint venture between the State Bank of India and the Carlyle Group. In this article, we will delve into the specifics of SBI Cards, exploring its features and offerings.

Table of Contents

sbi card

sbi card is a notable credit card issuer in India, providing a diverse range of credit cards customized to meet various customer preferences, such as travel, shopping, rewards, and lifestyle. Some of the popular SBI credit cards include:

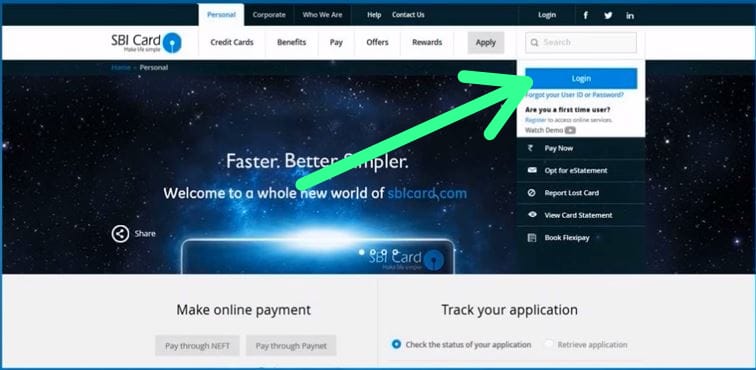

sbi credit card login

To access your SBI credit card account and manage your finances, you can easily log in to your account on the official SBI Card website by following the steps below:

sbi card app

For convenient access to your SBI credit card account and seamless management of your finances on the go, follow these steps to download the SBI Card app:

- Download The SBI card App from “The Play Store” or “App Store“.

- Launch The SBI card App.

- Click on “Sign In” and get started.

sbi card status

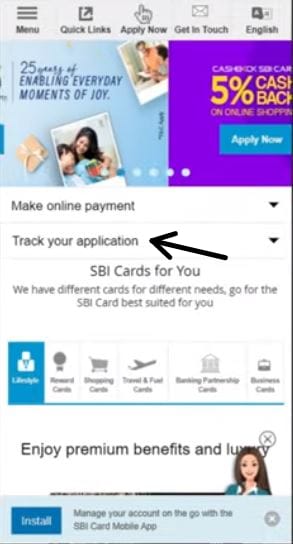

To easily keep tabs on the status of your SBI credit card application, just visit the SBI Card website. This guarantees a seamless and trouble-free experience while monitoring the progress of your application. Here’s how:

1- Go to the official SBI Card website.

2- Look for the “Check Application Status” option.

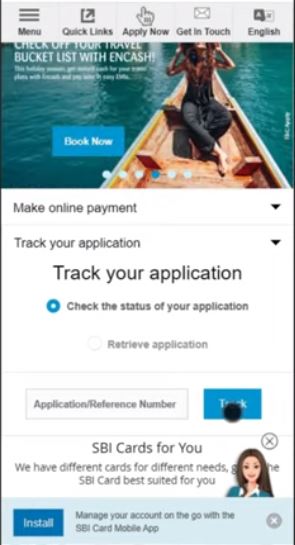

3- Enter your “application/reference number” and click on “Track.”

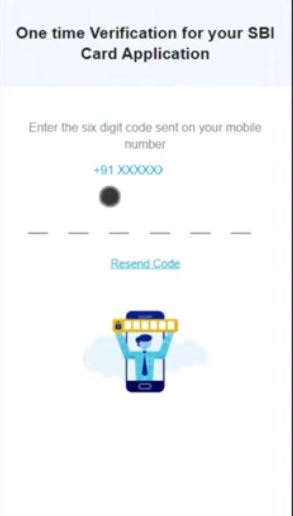

4- Enter the one-time verification code sent to your mobile.

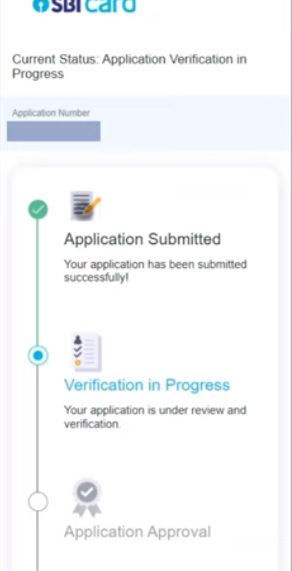

5- View your application status.

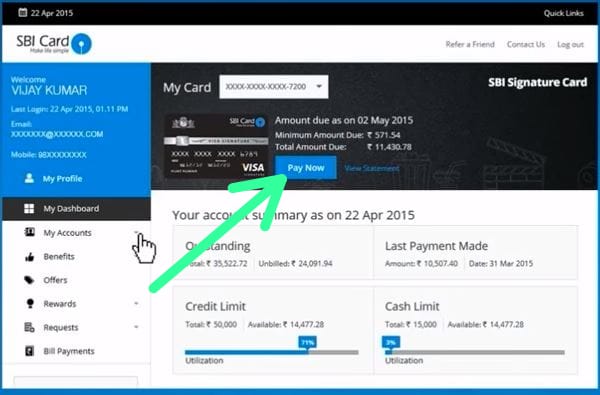

sbi card payment

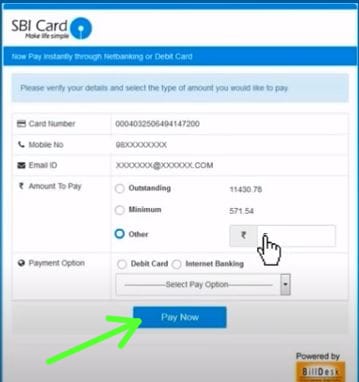

Effectively handling your SBI credit card payments is crucial for maintaining financial stability. Below, you’ll find uncomplicated instructions to execute secure and stress-free payments using the SBI Card platform:

1- Go to the official SBI Card website.

2- Log in to your SBI Card account.

3- Locate and click on “Pay Now”.

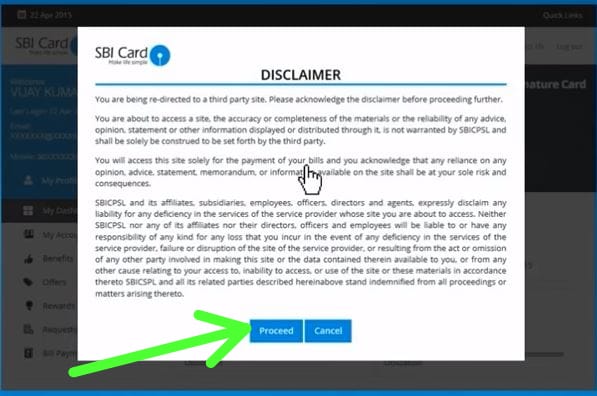

4- Agree with the disclaimer and click on “Proceed”.

5- Fill in the provided form with the necessary details and click on “Pay Now”.

6- Upon successful payment, receive a payment confirmation message.

how to block sbi atm card

To quickly block your SBI ATM card, you have two convenient choices. You can opt to either utilize the SBI mobile app or make a phone call to SBI customer care. Here’s how:

Via phone call

Upon realizing the ATM card is lost, the account holder can contact the SBI ATM card block helpline at either 18004253800 or 1800112211. This toll-free SBI ATM card block number provides an IVRS option, guiding the account holder on the steps to block the SBI ATM card. Adhere to the instructions, and the ATM card will be swiftly blocked.

Via SBI card

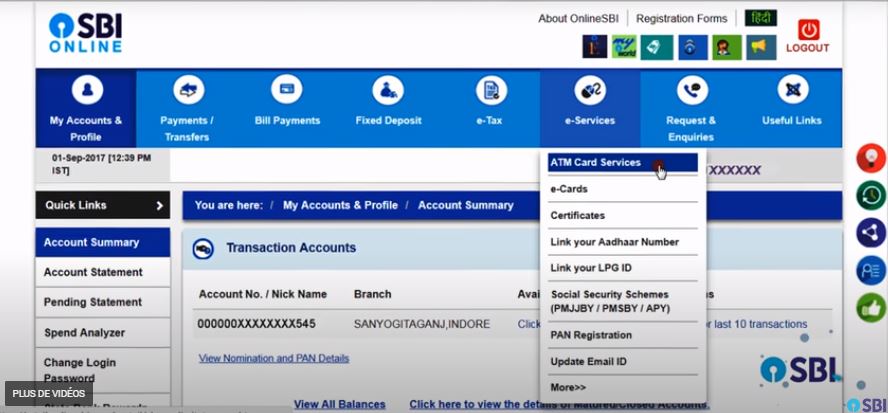

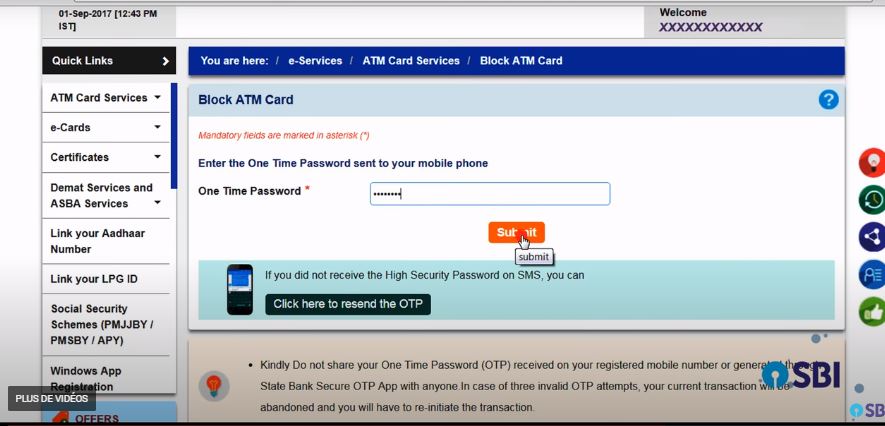

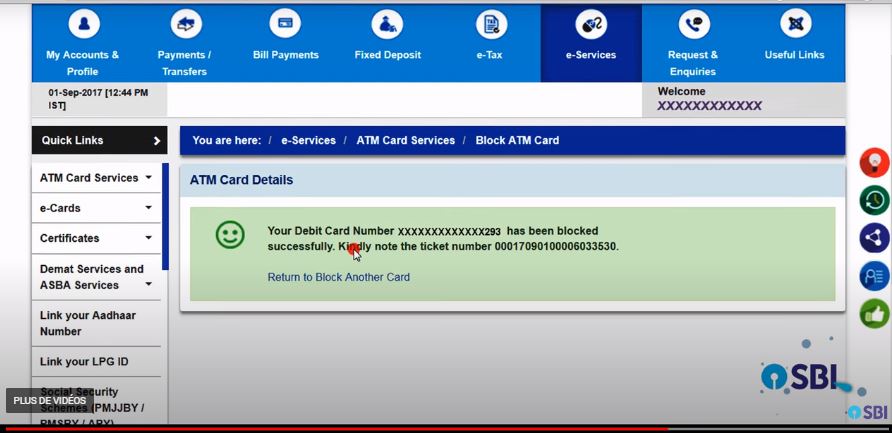

1- Go to the official SBI Card website.

2- Log in to your SBI Card account.

3- Navigate to “Services” from the home screen.

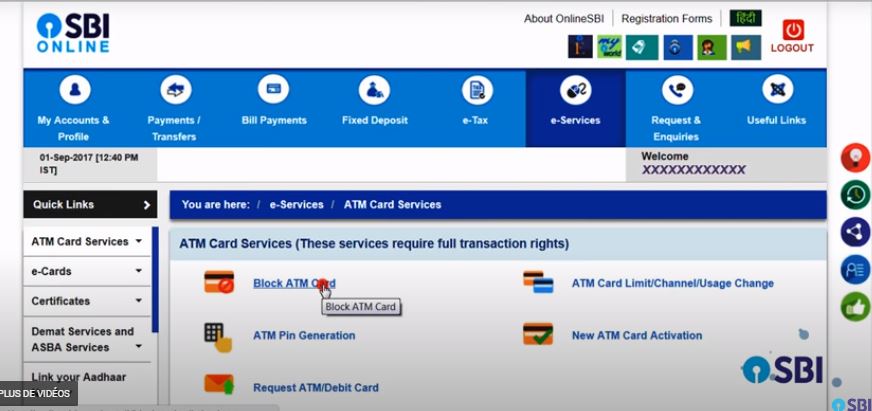

4- Choose the “Block ATM Card”.

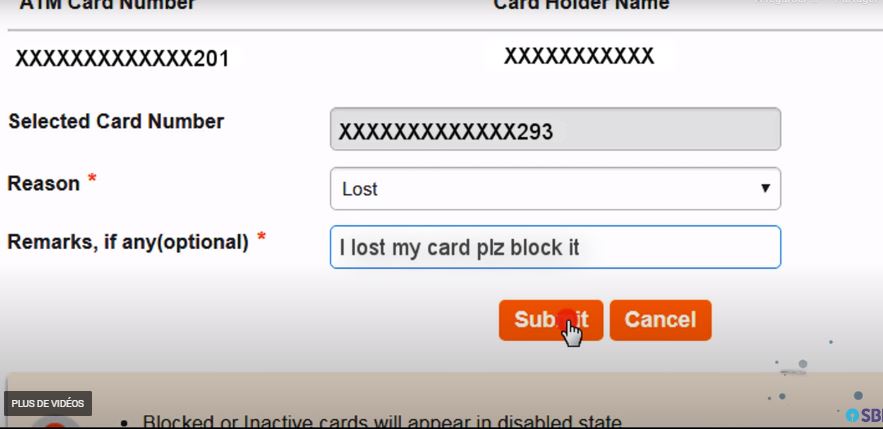

5- Select the reason: “Lost” or “Stolen” and click “Submit”.

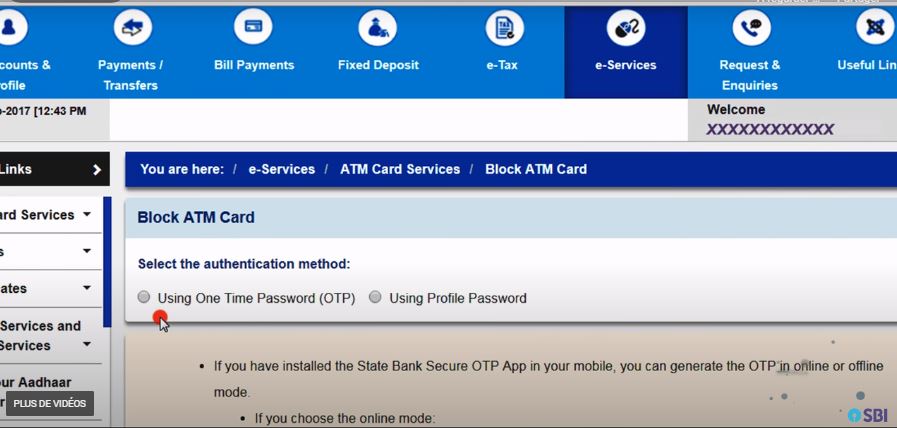

6- Choose the validation method.

7- Confirm by providing the OTP.

8- Your SBI ATM card is now successfully blocked.

read about: central bank of kuwait: Fueling Economic Success

sbi card customer care

If you have any inquiries or require assistance with your SBI credit card, feel free to contact the SBI Card customer care. You can reach them by dialing 18605001290, 18601801290, or 39 02 02 02 (with a local STD code). Additionally, there is a toll-free option at 18001801290. The dedicated customer care team is available to assist you from 8 AM to 8 PM, Monday to Saturday.

sbi card logo

The SBI Card logo is a distinctive symbol that embodies the identity and values of SBI’s credit card services, representing reliability, trust, and a commitment to customer financial well-being.

In summary, sbi card provide a versatile range of options with attractive benefits, robust rewards, and user-friendly features, making them a reliable and rewarding choice for diverse financial needs.

Frequently Asked Questions

Leave a Comment